Why Should You Automate Your Mutual Fund Redemption Payout?

Posted under case studies on December 22 , 2020 by Nikita Prashar

What Is Mutual Fund Redemption?

In the finance world, the repayment of any money market fixed-income security at or before the asset's maturity date is known as redemption.

When investors make redemptions by selling part or all their investments in mutual funds, it is called mutual fund redemption.

The mutual fund redemption process can be quite tedious. It involves validation checks for all the redemption requests received at asset management companies or mutual fund houses.

On top of that, these redemption requests can come from multiple banks since investors approach redemption via various bank portals.

The Mutual Fund Redemption Process

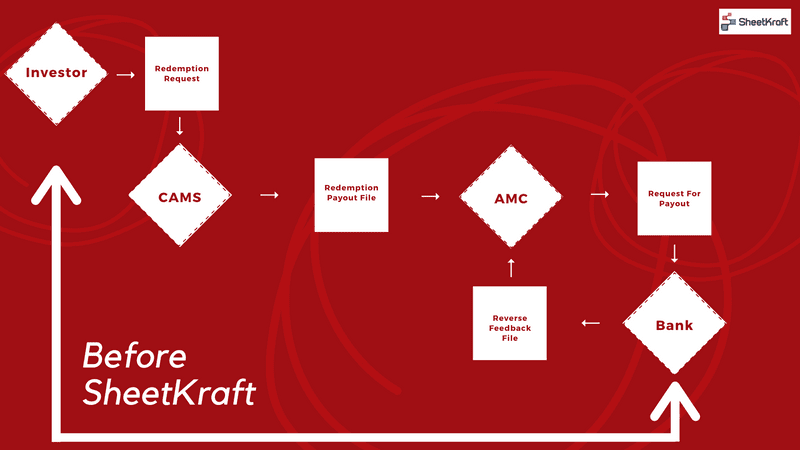

The redemption process typically involves the validation of the requests received in the redemption report. These requests can then be redeemed using several methods.

The transaction is initiated by CAMS after receiving the redemption request from investors. CAMS then sends this file to the asset management company or mutual fund house.

In response, the asset management company or mutual fund house replies with a reverse feedback file. This is done after the respective banks have validated the transactions.

- An investor sends a request for redemption to CAMS for an asset they hold with a particular asset management company or mutual fund house

- CAMS gathers all the requests received and creates a file. This file is sent to the asset management company or mutual fund house

- This file is forwarded to the respective banks for carrying out the redemption payouts to the investors

- Bank validates the request and adds remarks for each of the transaction whether it has been processed or rejected. Known as the reverse feed file, the banks send this file to the asset management company or mutual fund house

- The asset management company or mutual fund house notifies CAMs about the rejected transactions. These are re-processed by CAMS. The cycle goes back to step 2 and continues till the transaction is processed.

The Mutual Fund Redemption Process

There are several aspects to consider during the mutual fund redemption processing.

But the major problem with manual mutual fund redemption processing is reconciliation.The reconciliation is done on the **overall transaction amount of the day**. This makes it difficult to trace **individual failed transactions**.

The cumulative impact of these errors can severely affect the overall accuracy of the redemption process.

Let’s say, CAMS receives a total of 1000 redemption payout requests on a given day. Out of those, 900 are processed and the rest were rejected. These 100 requests are reprocessed by CAMS on the next day.

This process can be repeated for rejected transactions for 14 days from the first day of request.

Additionally, investors can select any of the several methods for mutual fund redemption while submitting their request to CAMS. These requests can also be requested in different ways by different banks.

For example, a request from bank A can be RTGS, the next request from a different bank could be via the bank transfer option, and so on.

All of these combinations make redemption processing very difficult to do manually.

Benefits Of Mutual Fund Redemption Automation

A good process automation solution can perform the reconciliation at a transaction level. So instead of just a cumulative daily amount, it can save the transaction level records in a data repository. Here are some of the benefits of mutual fund redemption automation:

- Reconciliation of files at a transaction level instead of the cumulative daily amount

- Validation of the report from CAMS to asset management companies or mutual fund houses and the vice versa have the same transaction list

- Matching of transaction amounts in both the reports and highlighting any discrepancies

- Checking if a transaction is accepted or rejected and storing the information in the database

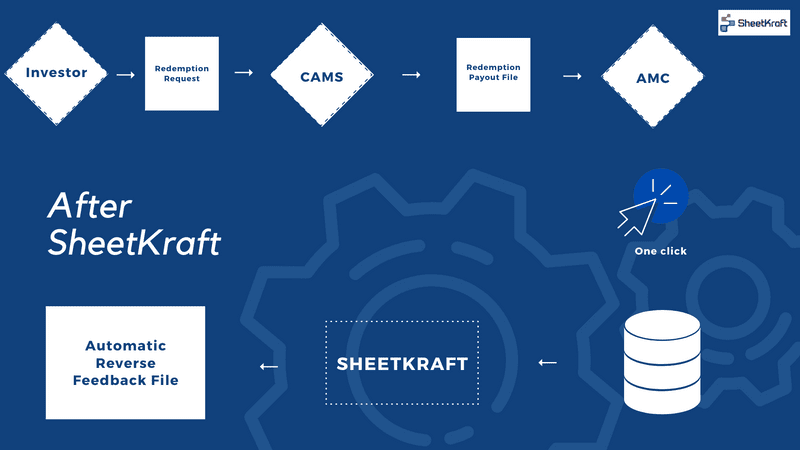

Mutual Fund Redemption Automation Using SheetKraft

SheetKraft’s mutual fund redemption automation provided our client with all the benefits mentioned above. Apart from those, SheetKraft was able to help our client serve their investors better by reducing the overall workflow and turn-around time.

Previously, multiple redemption requests were coming in throughout the day. As a result, our client had to contact CAMS all the time to get status updates.

After SheetKraft automated the whole process, the status updates received from the banks’ reverse feedback files are stored locally.

This enabled our client to access the required data whenever required without having to contact CAMS.

The transaction-level data stored in the data repository also helped our clients in conducting trend analysis that helped them in analyzing their business from banks.

The discrepancy/missing transactions between the CAMS report and the reverse feed file report are now being automatically highlighted.

SheetKraft's mutual fund redemption process automation reduced turn around time from 4 man-days to less than 15 minutes.

TAGGED:RedemptionCAMSMutual FundsPayout

Let's talk

Address

7th floor, Unit No. 715, C Wing,

Kailas Business Park, S. Veer Savarkar Marg,

Park Site, Vikhroli (W), Mumbai-400079.