SAST (Substantial Acquisition of Shares and Takeovers)

Posted under case studies on March 25 , 2020 by Nikita Prashar

Definition

The SAST Regulation by SEBI, were mainly added to regulate the acquisition of shares and voting rights in Public Listed Companies in India. This regulation by SEBI (Indian regulator for financial markets) is pertinent to asset management companies (or mutual funds (MF)) which hold, and trade equity of various companies listed in the equity market like BSE, NSE etc.

Scope Of The Problem

Just as regulations related to most financial services, this regulation is quite comprehensive. It covers direct acquisition of shares, indirect acquisition of shares, context of voting rights, offers, process when shares are de-listed, etc. The client’s compliance team proposed automation to make the process optimal. Since SheetKraft was already being used as automation platform for this client, SAST was taken as another project by SheetKraft.

Before SheetKraft

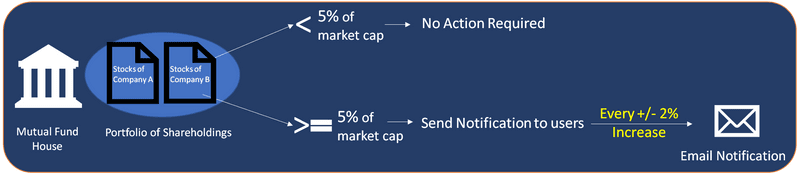

As per the SEBI guidelines, every security must be monitored closely to keep a tab on current holding percentage for every issuer/company.

- If a company holds more than 5% of the total shareholding percentage, then the matter must be disclosed by the Mutual Fund Board to SEBI.

- Since SAST are regulations, MFs are expected to adhere to them strictly else can be categorized by SEBI Regulations as non-compliant.

- A document and notification letter are to be sent to the SEBI and this company’s holdings must be monitored daily by the compliance team for every +/-2% increase in holding percentage. A holding below 5% means the company is compliant with SEBI rules.

- This process involves a huge risk. The complexities arising during the calculations of triggers are high as shareholdings are spread across schemes of mutual funds.

| Triggers | Action |

|---|---|

| >5% | Notification and document sent to SEBI |

| +/-2% post 5% increase | Continuously monitored and notification and document sent to SEBI |

| <5% | Compliant with SEBI, no action required |

Before Sheetkraft, team had to continuously monitor the holding percentage. This required a lot of manual work and involved greater risk of missing out on a trigger. If a trigger is missed, the mutual fund company becomes non-compliant with SEBI regulations Each time, there is an increase of 2%, an email must be sent. The process involves continuous monitoring. It therefore demands a lot of time and effort. Moreover, due to the massive amount of data, the manual process had a high error rate making the process quite inefficient.

SheetKraft’s Approach

Before SheetKraft’s SAST report generation solution was implemented, the process involved using many productive hours of an employee. Post implementation of SheetKraft’s solution, there is no manual intervention required.

- The solution captures and reads the holdings data, calculates the current holding percentage for every Issuer/Company.

- SheetKraft calculates the company’s holdings. If there is a breach of holdings percentage (5% threshold is crossed), a document and a notification letter is automatically created by SK application. Companies not present earlier in the “5% Companies” database are added to it for further monitoring.

- The companies in the “5% Companies” table are monitored for changes in the holding percentage. Any change that is more than or equal to 2% from the last reported percentage is reported via email. Any company with holding falling below 5% is removed from the “5% Companies” table and is no longer monitored.

- A summary report of all the “5% Companies' with their current positions and changes from the last reported percentage is emailed to the internal stakeholders and Mutual Fund compliance team

TAGGED:Mutual FundsSEBIShareholdingAutomation

Let's talk

Address

7th floor, Unit No. 715, C Wing,

Kailas Business Park, S. Veer Savarkar Marg,

Park Site, Vikhroli (W), Mumbai-400079.