A Case Study On Right-Sell Of Financial Products

Posted under case studies on April 09 , 2020 by Poorna Ganapathi

Common people without financial literacy often seek advice from banks to help them make sound investment decisions. Therefore it is important that there are rules and regulations laid down to protect their rights.

One such rule is right-sell.

In this case study, we will talk about what the right sell is and how banks can monitor the right-sell compliance efficiently using an automation platform like SheetKraft.

What Is Right Sell?

Right sell is the process of selling a customized financial product to a client. It is determined based on a client's profile and the bank-product suitability matrix.

Although the code of right-sell does not supersede regulatory or supervisory instructions of the Reserve Bank of India (RBI). It aims to set stricter standards than what is indicated in the regulatory guidelines.

RBI released a Charter of Customer Rights specifying the following five basic rights that the customers can enjoy:

- Right to fair treatment

- Right to transparency, fair and honest dealing

- Right to suitability

- Right to privacy

- Right to grievance redressal and compensation

In case a bank violates any right laid down by the RBI, customers can approach the customer services division of the apex bank.

Right Sell Of Financial Products – A Case Study

The compliance team of our client - a leading bank was overseeing whether the bank's processes were in accordance with the RBI guidelines

They had set a target for mis-sell ventures for a policy. Mis-sell ventures are times when the bank failed to provide the right financial products to clients. Every reputable bank aims to reduce this number and our client was no different.

Therefore, there was a stringent set of tasks that had to be done when there were the norms of right-sell were violated. This included analyzing a large chunk of data, then mapping it to the relevant branch, cluster, circle, and region information.

Once the mapping is done, the data belonging to a violating particular branch is further analyzed. The dataset is then segregated based on the right-sell norms following

Manual Process Of Right Sell Of Financial Products

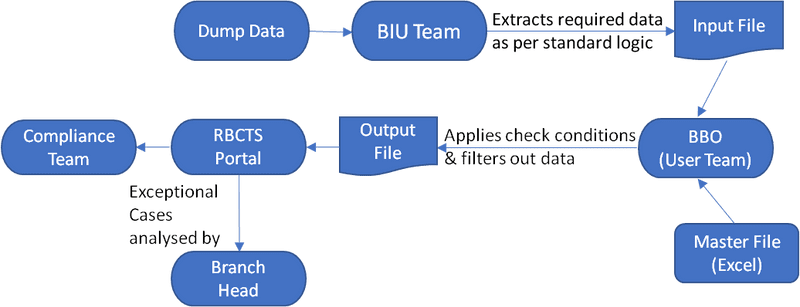

Our client was following a manual and long chain of steps to get the data required by branch heads to analyze any violation of right-sell rules.

The process started with the bank's various branches sending the Business Intelligence Unit a set of data.

The Business Intelligence Unit applied standard logic to extract some data points. These data points were then sent over to the Branch Banking Operations team.

The Branch Banking Operations team used this data along with another excel file stored in the database as their input.

The master file was used to collate the branch zonal data and then the whole data was filtered as per the conditions specified for the given monitoring activity.

The output file from this process was uploaded onto the Retail Business Compliance Tracker System portal by the Branch Banking Operations team.

Finally, the branch heads could access the data to analyze the exceptional cases.

As you can see, the entire process is cumbersome, prone to errors, and take a lot of time. Our client realized this and asked our team to automate this entire chain of steps using SheetKraft.

Automatic Right Sell Of Financial Products With SheetKraft

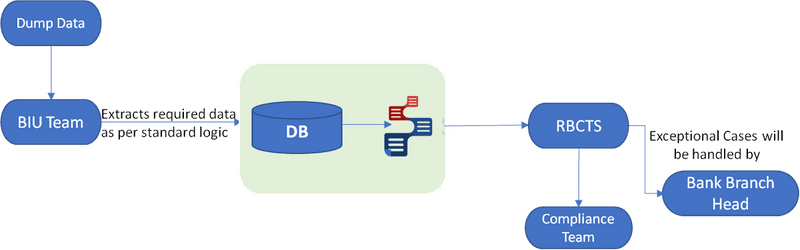

Once our team understood and fed the entire logic into our system, the process became completely automatic. Now the Branch Banking Operations team simply enters the month and year they want to access.

SheetKraft automatically extracts the required data from the Business Intelligence database. Then it updates the output file onto the Retail Business Compliance Tracker System portal.

As a result, our client achieved the following:

- Complete elimination of manual intervention for performing checks

- A massive reduction in turn around time as there are 19 such monitoring activities

- Marked improvement in cooperation between branch banking operation teams that are distributed across the country

SheetKraft's right sell automation reduced the turn-around time from 6 hours to less than 5 minutes.

TAGGED:Regulatory ReportingRight-Sell

Let's talk

Address

7th floor, Unit No. 715, C Wing,

Kailas Business Park, S. Veer Savarkar Marg,

Park Site, Vikhroli (W), Mumbai-400079.