Passive Breach Reporting: A Case Study On Regulatory Reporting Automation

Posted under case studies on June 02 , 2020 by Rohan Jangid

A mutual fund’s investments are handled by its in-house fund managers. A fund manager’s primary job is to invest the retail investors’ money in securities and share the returns with the investors.

Additionally, they also have to increase the value of the fund to satisfy its internal objectives.

But there are several regulations a fund manager has to keep in mind while investing. Some are set internally by the mutual fund house.

Others are set by regulatory bodies of the county in which the fund is based. One such strict regulation is passive breach reporting.

The Mutual Fund Regulatory Reporting Process

When a mutual fund scheme is launched and offered to the public, it is called a new fund offer (NFO). An NFO provides a document to its initial investors known as an offer document (OD).

The offer document contains the profile of the fund, the fund’s objective, and the limits of various investments.

These limits or restrictions are known as offer document (OD) limits. And they must be adhered to by the fund Manager.

The OD limits help the investors make educated decisions regarding their investments. This is done by examining the objectives and the risk profile of the fund.

Other restrictions are imposed by regulatory bodies. In India, SEBI imposes several limits on a fund's investments to avoid any large concentration of a security, industry, or company.

Thereby eliminating any risk of having all eggs in the same basket. These limits are known as regulatory limits.

Then there are also internal limits set by the mutual fund houses for their internal use. Or as an alert system to track any breach in the regulatory limits. This is known as a credit limit.

Mutual fund analysts study a company’s credit profile based on the credits provided by an approved credit rating agency.

Based on the ratings, the analysts assign an investment limit for a period of time. The higher the time period, the lower will be the investment limit and vice versa. This is because risk increases with time.

Case Study – Passive Breach For An AMC

Regulatory regulation adherence is typically managed by the risk department in mutual fund houses. Our client, a leading asset management company (AMC) used to manage their passive breach reporting manually.

In the upcoming sections, we will talk about their journey from manual, generic automation platforms to SheetKraft and the challenges they faced on their way.

Problems With Manual Passive Breach Reporting

Doing passive breach reporting manually posed a lot of problems for our clients. Some of them are listed below:

- Complicated use of Macro Excel

- Creation of additional excel sheets for every new limit

- No availability of centralized data

- Auditing was impossible

- Slower processing and TAT

- Prone to manual errors

Passive Breach Reporting With Generic Automation Platforms

Due to the excruciating problems related to manual passive breach reporting, our client moved on to Generic automation platforms that solved some of the problems that manual processing posed. But they failed to hit the bull’s eye.

Some of the limitations of generic automation platforms that our client faced are as follows:

- Only a generic set of limits could be created

- Complexity in limit is were not entertained (Only a linear connection of AND or OR)

- New limits could be created by the users themselves

- Calculation and report generation was done on user machines, making it too slow for anything else

- It did not have the option of backdated calculations

- There was no provision of bulk calculations

- Users had to retain each report for audit purposes

How Did SheetKraft help in Passive Breach Reporting?

Our client approached us to create a stand-alone application to automate their passive breach reporting. This included the entire chain, right from uploading data to generating reports.

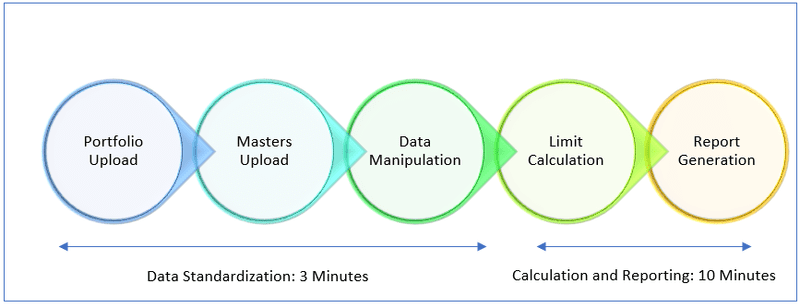

The above flowchart is for our AMC client having 150+ mutual funds and 150+ limits.

Some of the features of SheetKraft’s automatic passive breach regulatory reporting:

- A common user-friendly platform to encompass all the limits

- SheetKraft’s processes combining feature to cover the entire process in just 2 steps

- Addition and editing of limits or masters by the users themselves

- Creation of new versions of a limit per policy changes

- Use of SQL for calculation enabling users to include any complexity in the limits

- Utilizing servers to do any calculation to avoid any load on users’ machines

- Provision for backdated calculations

- Provision for bulk calculations

- Audit trail maintenance to avoid keeping downloaded reports on the machine

- Generation of Limit-wise report, dashboard report, and trend report

- Scheduled data import from NSE, AMFI websites

- Limit value update by users themselves as everything is mapped with a date

- Separate module for a credit limit

Creating a limit for passive breach reporting on SheetKraft

Let us go through an actual limit imposed by SEBI onto the mutual funds and understand how SheetKraft can be used to regulate it.

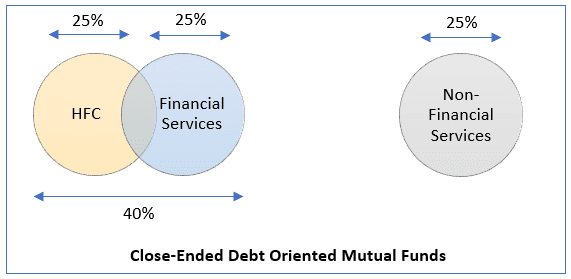

As per SEBI, mutual funds/AMCs shall ensure that total exposure of debt schemes of mutual funds in a particular sector (excluding investments in Bank CDs, CBLO, G-Secs, TBills, short term deposits of Scheduled Commercial Banks and AAA-rated securities issued by Public Financial Institutions and Public Sector Banks) shall not exceed 25% of the net assets of the scheme.

Provided that additional exposure to the financial services sector (over and above the limit of 25%) not exceeding 15% of the net assets of the scheme shall be allowed only by way of increase in exposure to Housing Finance Companies (HFCs).

Provided further that the additional exposure to such securities issued by HFCs are rated AA and above and these HFCs are registered with National Housing Bank (NHB) and the total investment/ exposure in HFCs shall not exceed 25% of the net assets of the scheme.

Source: SEBI Circular

The above draft from the SEBI circular can be divided into 4 simple parts:

- In Closed-Ended Debt Schemes, investment in Non-Financial Services should be less than 25%.

- In Closed-Ended Debt Schemes, investment in HFCs and Financial Services should be less than 40%.

- In Closed-Ended Debt Schemes, investment in only HFCs should be less than 25%.

- In Closed-Ended Debt Schemes, investment in financial services, and no HFCs should be less than 25%.

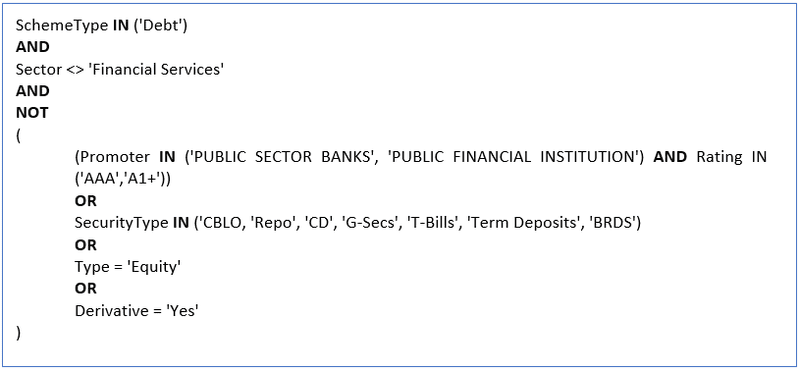

A given condition [Filter] is used to select the relevant data for the aggregation of the investment/market value.

The below filter is for the first limit, Investment in debt scheme and non-financial services should be less than 25%.

Using the above filter, we will get the SUM (Market Value) [Variable 1] and divide that with the AUM [Variable 2] at Scheme and Sector level.

And this ratio [Aggregate Variable] should be less than 25% [Parameter Value] according to the limit.

Similarly, other 150+ limits are structured and stored in different database tables. The calculation is done for each limit over the standardized portfolio data and reports are generated.

Impact Of Automating Passive Breach Reporting With SheetKraft

The two-step process has substituted the earlier rigid system. The flexibility to add multiple and nested logic has helped to incorporate all the limits.

Including the ones that were maintained separately on excel and were prone to error.

Our client is currently using SheetKraft’s Passive Breach Reporting module to run the backdated calculation starting from 2018 for audit check.

SheetKraft has helped in the complete elimination of manual errors with multiple validation checks.

This enabled our client to conduct a sanitary check of all the masters and rectify in case of any error.

SheetKraft's stand-alone application has provided a simple tool for Passive Breach Reporting. This has helped our client mitigate all risks of regulatory breaches that could turn into severe non-compliance issues.

TAGGED:Regulatory ReportingPassive Breach

Let's talk

Address

7th floor, Unit No. 715, C Wing,

Kailas Business Park, S. Veer Savarkar Marg,

Park Site, Vikhroli (W), Mumbai-400079.