Net Interest Margin (NIM)

Posted under case studies on March 30 , 2020 by Somiya Agnihotri

Definition:

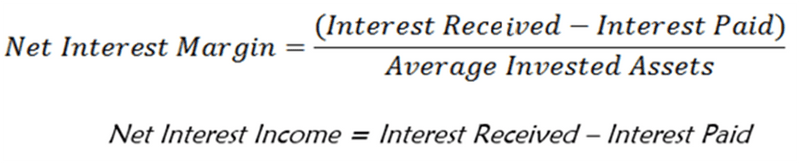

In finance, net interest margin is a measure of the difference between interests paid and interest received, adjusted for the total amount of interest-generating assets held by the bank.

- Net interest margin (NIM) reveals the amount of money that a bank is earning in interest on loans compared to the amount it is paying in interest on deposits.

- NIM is used as indicator of a bank's profitability and growth.

- Net interest income between banks varies to a large extent depending on the type of loans, asset quality, change in the yield on interest-bearing assets and interest paid on deposits.

Scope of the Problem:

Net interest margin is calculated daily in a bank and reported to the CFO and the entire finance team. This report is of paramount importance to the top stakeholders of the bank since it is an indicator of the financial health of the bank. The whole process is complex and requires productive hours of the team to complete the task. The client’s finance and accounts team proposed automation and chose SheetKraft as the ideal automation partner to make the process optimal.

Process being followed before onboarding SheetKraft:

As per the Bank’s defined process, a person has to collect all the required files from shared folder on daily basis. The file received is to be converted into excel format and calculations are done in the Excel file. The team invested one hour daily to produce the report.

But, manual process involves high risk and high chances of error. The data can be misplaced or missed while copying from one place to another or the formulas can be applied with incorrect references. The team has to make several iterations to ensure that the NIM report is accurate.

SheetKraft’s Approach:

Before SheetKraft, the task required one hour to generate the report. But with the help of Sheetkraft, the task is competed in 20 seconds.

Triggers were created for:

- Fetching the input files for processing from the shared drive / SFTP

- Calculations and formatting of data is done dynamically without human interference

- Obtained output file is stored back into a separate output folder in the same shared drive / SFTP.

- The team receives a notification via email about the output file.

Automating the NIM process has made it more flexible for the employees and stakeholders as it can be accessed easily. Dependency of employee working on it has been decreased as the output is generated daily without human involvement. Error rates in the report are negligible and the report is now more efficient.

TAGGED:BankInterestProfitabilityFinance

Let's talk

Address

7th floor, Unit No. 715, C Wing,

Kailas Business Park, S. Veer Savarkar Marg,

Park Site, Vikhroli (W), Mumbai-400079.