IRS Valuation

Posted under case studies on April 29 , 2020 by Shelvi Gupta

Definition:

An interest rate swap (IRS) is an agreement between two parties to exchange one stream of interest payments for another, over a set period. Swaps are trade over-the-counter. Interest rate swaps can be fixed or floating rate in order to reduce or increase exposure to fluctuations in interest rates.

Scope of the Problem:

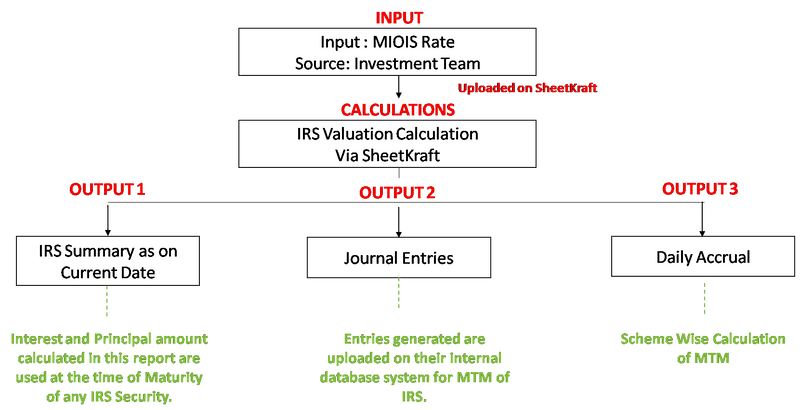

IRS Valuation is a complex problem. It is for the daily calculation of unrealized appreciation/depreciation of their IRS securities. IRS Valuation results are daily uploaded in their internal database system. The calculated Interest is daily compared with the values in their internal system, it is further used at the time of maturity of IRS securities. AMC(Asset Management Company) Mutual Fund’s Operations team proposed automation to make IRS Valuation process more efficient. Journal and Daily account accrual reports are generated as a part of IRS Valuation.

Before SheetKraft:

IRS Valuation is done daily to update the value of approximately 100 unrealized securities. The time taken to complete IRS Valuation before sheetKraft was more than 30 mins.

- Daily MIOIS (Mumbai Interbank Overnight Indexed Swap) rate was updated to calculate mid-rate for all the securities.

- There was no storage of previous day’s data, so Interest was calculated from start date till the current date using MIBOR(Mumbai Interbank Offer Rate) every time valuation was done. This whole calculation was done for all the securities.

- Similarly, Principal amount was calculated from the start date till the current date for all the securities every time valuation was done. Before SheetKraft, Operations team had to do a lot of manual work, there was no proper storage of data and hence values were calculated daily for all the securities. The reports were not efficient enough due to lack of manual work involved.

Automating it with SheetKraft:

Operations Team approached us for automating the IRS Valuation process, Sheetkraft team identified that the process has a logical structure and can be automated. Automation will increase the process efficiency and reduce the time spent on this process. After automating the whole process with SheetKraft, the time taken is few seconds.

- Activity “IRS Security Master” is created to upload all the IRS securities, team can add and update securities in this activity to the master.

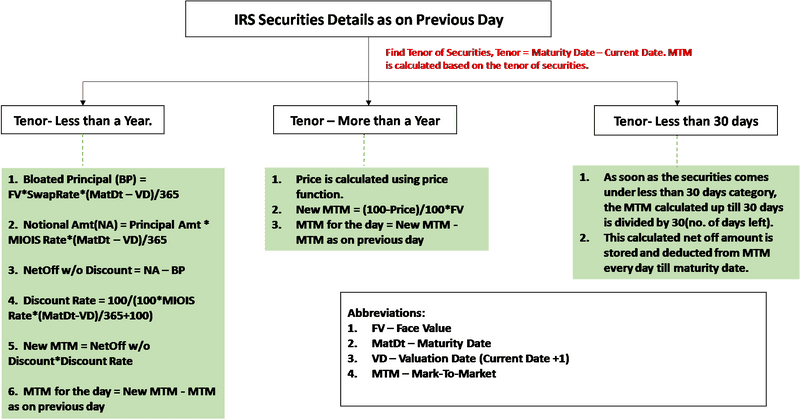

- IRS Valuation activity handles all the logic and calculation with basic input required like valuation date and MIOIS rate.

- The process updates all the interest, principal amount and MTM(Mark-To-Market) value as on current date in the IRS Security Master. Historical data are also stored in database.

- In case of any mistake while entering the input, team can revert the data for the last valuation.

- Along with IRS Valuation, various reports like IRS Summary, Daily Account Accrual and Journal Entries are also generated. Validations are added to avoid error or overlapping of data.

Flow Chart Of IRS Valuation Process:

IRS – MTM Calculation:

Overall Impact:

- The whole implementation has made IRS Valuation process more efficient.

- Before SheetKraft the process was time consuming, now the time taken by IRS Valuation to complete and generate all reports is few seconds.

- It is easy to manage the data and can be easily retrieved at any point of time.

- There are additional scope to update the securities or revert the last valuated data in case of any input error.

TAGGED:IRSMutual FundsValuation

Let's talk

Address

7th floor, Unit No. 715, C Wing,

Kailas Business Park, S. Veer Savarkar Marg,

Park Site, Vikhroli (W), Mumbai-400079.