Invoice Reconciliation With Purchase Order - 4 Challenges That Banks Face

Posted under case studies on November 23 , 2020 by Dheeraj Sangore

Reconciliation is an essential business process these days. It involves comparing 2 or more records to determine if they match and ascertain the variations if any.

Therefore, all industries undertake reconciliation activities to avoid discrepancies and rectify errors. One such sector is banking. Banking involves a lot of data processing and in the process, some inconsistencies may turn up.

Our article takes a simple example and gives an overview of how our automation solutions like SheetKraft use reconciliation modules to automate invoice reconciliation between purchase orders given to internet providers and their corresponding invoices for a bank. It also talks about the top problems and the 4 major invoice reconciliation challenges the bank faced due to manual reconciliation.

WHAT IS INVOICE RECONCILIATION?

Invoice reconciliation is the process of matching statements with ingoing or outgoing invoices to ensure that all accounts are in order and all the book entries match. Any discrepancy that is noted is sent for correction.

PROBLEMS WITH MANUAL INVOICE RECONCILIATION

Our clients – a leading bank needs to check the invoices raised by their internet providing vendors with the purchase order raised by their internal procurement department.

They have a number of branches in various cities spread across the country. These branches are identified by unique Sol IDs. The complications arise because each of these branches avail internet services from various internet providers.

Therefore, they need to reconcile the received invoice data with the data they have in their purchase order master file for each of these vendors.

Also, there are several elements that needs to be checked such as bandwidth, invoice period, PO number, SOL ID, commissioning date, Invoice Amount, Invoice Period, Annual Recurring Charges (ARC) amount, one-time charge (OTC).

Referred to as Network Reconciliation, these chain of processes for matching the records of vendor invoices and PO data can get quite complicated. And only when the data is matched, the invoice is sent to the Finance department for clearing dues.

The bank wanted to automate the entire process of gathering of the purchase order and invoice data from various sources, and reconciling them asper the following validations:

- Invoice period should lie between Purchase order periods

- Invoice not already paid or Invoice payment in process

- PO number, Vendor Details, Bank Branch Name, Purchase Order Amount, Service description (bandwidth- 1mbps ,2mbps etc.) should match for PO Data and the Invoice

- Amount raised in invoice should be less than or equal to the Purchase Order amount on pro rata basis and the pending amount for the entire Purchase Order Period

4 CHALLENGES WITH INVOICE RECONCILIATION FOR BANKS

- Large dataset – Since the elements that need to be reconciled are large in number, the dataset is huge.

- Data inconsistencies – As there are several vendors and branches involved, it was difficult to match PO and invoice data.

- Excel dependency - Depending on excel files for storing a large number of records makes it slow and complicated.

- Time duration discrepancies – Problems in identifying the period for which an invoice is paid from PO data.

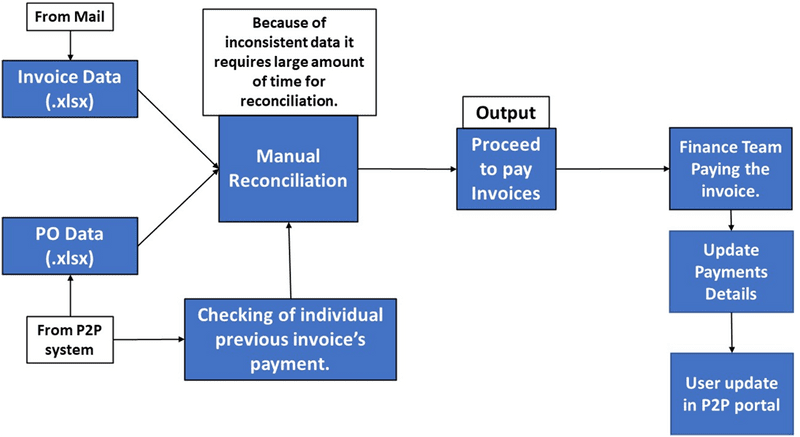

PRE – INVOICE RECONCILIATION AUTOMATION

- Purchase order and Invoice data stored in excel

- Data inconsistency leading to a messy the reconciliation process

- No common field between invoice and PO data to filter already paid invoices.

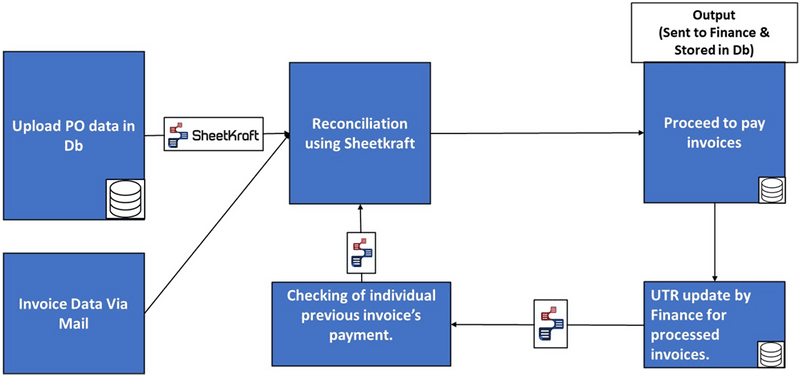

POST – INVOICE RECONCILIATION AUTOMATION (USING SHEETKRAFT)

- A holistic approach to cover all possible scenarios

- Elimination of excel dependency for storing a large amount of PO data

- Automation of the entire chain of reconciliation processes to ensure error-free checking

- Storage of invoice record in the database for easy checking of paid invoices and invoices in process

Paid Invoices and Invoice payment in the process are now distinguishable through UTR number mapped against the Invoices. users had to manually go into the Finance Payment Portal to check for individual invoices. SheetKraft adds a check which the bank was sorely missing before.

SheetKraft's invoice automation reduced turn around time from 8 hours to mere 3 minutes.

TAGGED:ReconciliationInvoice MatchingPurchase Order

Let's talk

Address

7th floor, Unit No. 715, C Wing,

Kailas Business Park, S. Veer Savarkar Marg,

Park Site, Vikhroli (W), Mumbai-400079.