General Ledger Reconciliation – Definition, Importance, Process, Example

Posted under case studies on December 07 , 2020 by Muskan Jethmalani

General ledger reconciliation is extremely crucial, but the process is often complicated. Especially when done manually, it can soon turn into a huge chunky process that takes a lot of time.

And even with the amount of time spent, sometimes the results are not accurate.

Today we will take an example of general ledger reconciliation and see how reconciliation automation software like SheetKraft can quickly turn it into a smooth experience.

But before that, let's briefly touch upon the basics.

What Is A General Ledger?

A general ledger also called a nominal ledger, is a book-keeping system for a company’s financial data transferred from all the sub-ledgers like accounts payable, accounts receivable, cash management, fixed assets, etc.

What Is General Ledger Reconciliation?

General ledger reconciliation is the process of verifying a company’s ledger balance of accounts where the ledger record is compared with account statements, reports, and other systems to ensure that the balances are valid.

Why Is General Ledger Reconciliation Important?

General ledger reconciliation is performed to verify the integrity of the account balances on the company’s general ledger before making the financial status of a company public.

Therefore it is one of the most crucial parts of financial closing balance or process.

How To Do General Ledger Reconciliation?

The general ledger reconciliation process is done by an accountant or accounting firm. They go through each account in the general ledger of accounts and verify that the balance listed is correct and accurate.

General ledger reconciliation typically happens after the end of a financial period. However, general ledger reconciliation is necessary before issuing public financial statements.

Therefore, some companies also adopt daily, weekly, or monthly reconciliation to avoid being burdened at year-end.

The most important steps in general ledger reconciliation are:

1. Comparing Data

The general ledger account balance is compared to the information contained in other independent systems and sources of financial data such as bank statements and credit card statements.

Some banks also use reconciliation to compare the loan amounts and how much of it is yet to be received.

2. Highlighting discrepancies

Once the comparison is done, accountants highlight the discrepancies found if any.

3. Solving discrepancies

The accountants then research, investigate, and take appropriate action to correct these discrepancies. Corrective action may involve making journal entries to correct balance errors.

4. Final auditing

The research and investigation process is documented together with the corrective action, and all of this information is stored for audit purposes.

General Ledger Reconciliation Example

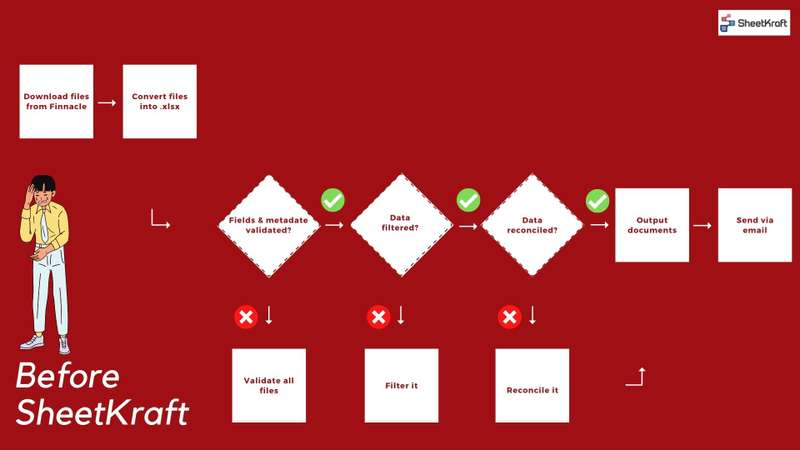

Let's look at general ledger reconciliation with an example. Our client, a leading bank was was general ledger reconciliation manually. There were around 10 of them and it took a lot of time - hours each and days cumulatively.

There are were several problems they were facing due to this. We will touch upon that in the next section. So they approached us to fund a solution that would help them get rid of these problems.

During the scoping process, we realized that one of the biggest challenges that our client was facing was a dependency on excel for a large amount of data.

We wanted to completely eliminate that. We also wanted to get the results quickly without having to think about fetching and compiling data from different sources.

Problems Manual With General Ledger Reconciliation

These are some of the significant problems with manual general ledger reconciliation:

- Huge Data Volume - A large amount of data saved in excel slows down the process and takes a lot of time to generate the desired output

- Varied Dataset – The data is stored in different files having multiple formats, making it exhausting to compile or compare

- Complex transaction relations - Due to complicated internal processes and various data sources and formats, transaction relations turn into a labyrinth - one-to-one, one-to-many, many-to-many.

Dealing with such cases involves sophisticated logic.

Benefits Of Automated General Ledger Reconciliation

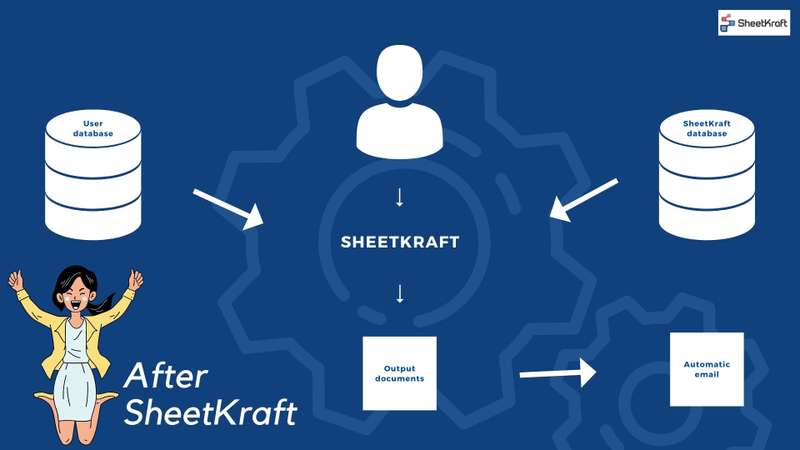

Automated general ledger reconciliation can get rid of all the complexities that are a part of the process and make it faster, easier, and error-free.

A good general ledger reconciliation automation software will also provide you a customized solution based on your unique reconciliation requirements.

Also, automatically run the reconciliation process in the background whenever needed, to generate the output.

Additionally, an automation software that can easily store large amounts of data in a database will be extremely useful to access easily whenever needed.

This completely eliminates the dependency of excel files for storing a large amount of PO data having lots of data inconsistencies.

How Did SheetKraft Help In Automating General Ledger Reconciliation Reports?

Our team quickly charted a plan to build a customized application for their general ledger reconciliation process. One that would give them the much-needed automation features as well as flexibility.

The most amazing impact that SheetKraft had was to reduce the overall time spent on this by our client considerably.

SheetKraft's general ledger reconciliation automation reduced turn around time from 10 hours to less than 10 minutes.

TAGGED:General LedgerReconcileBank Reconciliation

Let's talk

Address

7th floor, Unit No. 715, C Wing,

Kailas Business Park, S. Veer Savarkar Marg,

Park Site, Vikhroli (W), Mumbai-400079.