Branch Performance Report

Posted under case studies on May 08 , 2020 by Nitesh Singh

Branch Performance Report demonstrates the efficiency & productivity of retail bank branches to deliver banking services & experience to its customers. To analyse the customer experience, banks ask the customers to rate the bank branches on various parameters like bank’s services, variety of products offered, knowledge of resource, contact-ability, soft-skill of resources etc.

A Branch Performance Report helpsthe bank’s administration to get insight of functioning of each retail branch. The report summarizes all the parameters into a Score Card for each branch. The Score Card depicts the overall performance of the branch on the above-mentioned parameters. Based on the score card, bank’s administration decides the top performing branches and helps non-performing branches to focus on certain areas of development to increase their performance.It also helps the bank’s administration to improve their performance and increase their business on a comprehensive level.

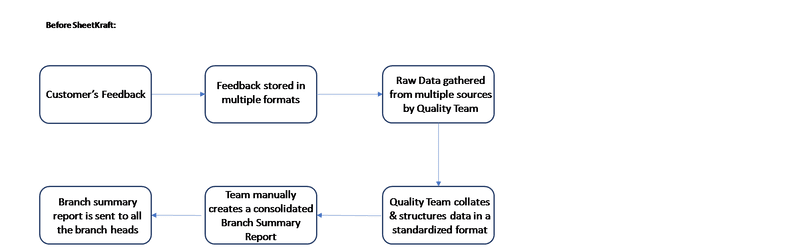

Before SheetKraft:

- All the data (feedback of customer’s) are recorded via feedback kiosks, SMS, E-mail, mobile/web applications and calls etc.

- The Quality Team sources this data from multiple teams (data is in various formats), structures it in a standardized format, performs the score calculations & generates the Summary Report.

- After generating the Branch Performance Reports, they are sent to the relevant Stakeholders via e-mail as an attachment which includes the detailed summary of all the branches in a single file.

- It was difficult for the team to send emails to many branches individually (ex: 4000+ branches).

- The manual effort required to generate personalized reports was substantial and slowed down the entire flow of updating the branches& senior management about their performance.

- This process was performed once in a month & took almost 2 days to complete.

Flow Chart:

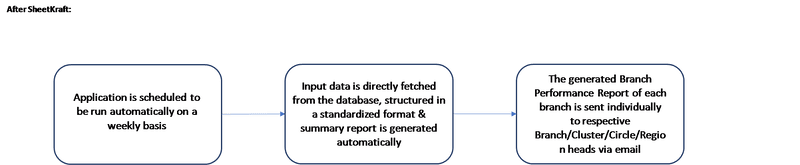

After SheetKraft:

- Using SheetKraft, the data required for calculation of each criterion is directly fetched from the database.

- The customer’s feedback on various parameters such as the bank’s services, products, knowledge of resource, contact-ability, soft-skill of resources etc. is considered for calculation. Calculations for generating the score card is done using SheetKraft based on the defined logic.

- The Bank can set their benchmark % (example - 90%) for each criterion. If any branch meets 90% benchmark score, then it will be tagged as “Best Performing Branch” and the non- performing branches would get to know about the parameters on which they need to develop and improve their performance.

- All the parameters are summarized into a single file unique for each branch & the same is shared via e-mail to the respective stakeholders. SheetKraft’sSend Email is used to schedule the mails to respective recipients.

Flow Chart:

Impact of Automating with SheetKraft:

After using SheetKraft, the reports are triggeredautomatically on a weekly basis to all the Regional, Circle, Cluster & Branch Heads. It hardly takes half an hour for the entire process of fetching the data, summarizing branch wise reports & sending e-mails to stakeholders (4000+) i.e. 2 hours per month against two days per month when done manually.

Apart from the Summary report being sent to the Branch heads, graphical & highlighted insights such as comparison with other branches in the area are also sent to the Cluster heads. Similarly, performance comparison of various clusters in a circle are sent to the Circle Heads & performance reports of various circles in a region are sent to the Regional Heads respectively.

The senior managementcan now parallelly compare the performance of each branch against allocatedtargets at a granular level,identify shortcomings and augment growth opportunities.

Frequent updates of this report helped the bank branches to improve their individual performance and get themselves categorized as the “Best Performing Branches”. This improved the performance and business of the bank significantly.

Let's talk

Address

7th floor, Unit No. 715, C Wing,

Kailas Business Park, S. Veer Savarkar Marg,

Park Site, Vikhroli (W), Mumbai-400079.