Bank Statement Reconciliation Explained With An Example - SWIFT Reconciliation

Posted under case studies on December 02 , 2020 by Mukul Chokhani

What Is Bank Statement Reconciliation?

Bank Statement Reconciliation is the tallying of data between an entity’s bank account with its financial record. The statement highlights any discrepancies in the two records and is done for a particular period.

Who Conducts A Bank Statement Reconciliation?

Bank reconciliation statement is typically prepared by the Operations and/or the Audit departments. But it can vary from organization to organization.

Bank Statement Reconciliation Statement Example (SWIFT Reconciliation)

Let’s look at bank statement reconciliation with the example of SWIFT reconciliation. Our client, a leading bank is a part of the SWIFT network.

They wanted to reconcile the accounting records shown on their bank statement and the SWIFT statement messages. But before we dive into the problem in-depth, let’s understand SWIFT.

What Is SWIFT?

SWIFT stands for Society for Worldwide Interbank Financial Telecommunications. It is a network of financial institutions worldwide that enables them to send and receive information about financial transactions in a secure, standardized, and reliable environment.

SWIFT is one of the largest financial messaging systems in the world.

SWIFT does not facilitate funds transfer. However, it sends payment orders which are settled by correspondent accounts that the institutions have with each other.

Financial Services firms are turning their attention towards reconciliation systems as data grows in complexity and volume.

The SWIFT Bank Statement Reconciliation Process

The bank maintains a record of this transactional information which they call the dump data.

The goal of the process is to ascertain the differences between the bank’s dump data and the data received from SWIFT that are then booked as changes to the accounting records.

Criteria For SWIFT Bank Statement Reconciliation

The criteria used for reconciling the bank statement and SWIFT are based on the type of messages. These are classified into the following:

- Payments - Customer Payments and Checks

- Trade Services - Treasury Markets-Foreign Exchange, Money Markets and Derivatives

- Securities - Documentary Credits and Guarantees

- Trading - Cash Management and Customer Status

Rules For SWIFT Bank Statement Reconciliation

The rules for this particular bank statement reconciliation is done on a transaction level. Each transaction from the SWIFT file is matched with the Bank records based on:

- Deal Number

- FBO Number

- Transaction Reference Number

- Related Transaction Reference Number

- Transaction / Settlement Amount

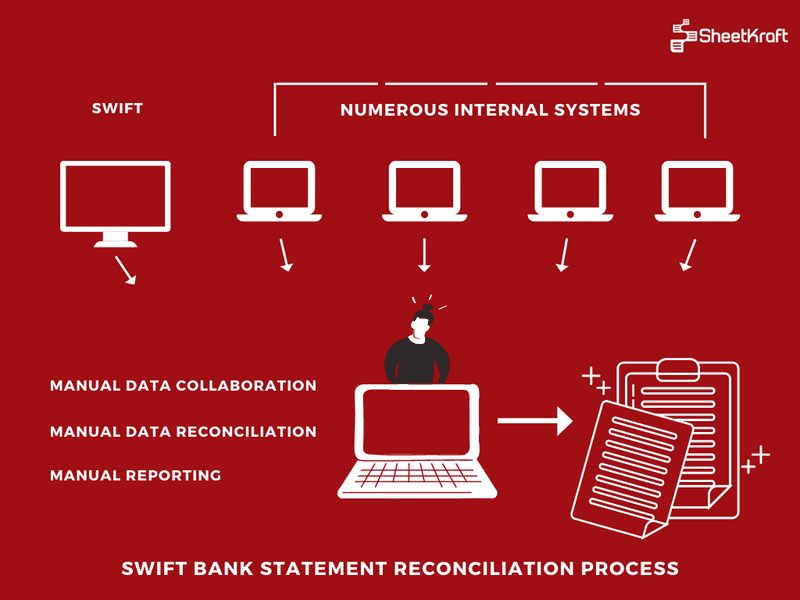

Problems With Manual Bank Statement Reconciliation

The required file to create the bank’s dump data is scattered across systems. Someone from the bank’s operations team needs to log into multiple places such as Finacle Treasury, Metagrid, and CCIL website among others.

On top of that, these data sets come in different formats. So, the user needs to open each file, scout for the relevant data, and collate all of it in a structured format.

Similarly, the files received from SWIFT are individually checked, and then the data is collated.

Out of all the rules stated in the previous section, the most important is the transaction or settlement amount matching. This particular reconciliation is done to book changes in the accounting records if any.

This process itself can take 3 – 4 hours when done manually using VLOOKUP on Excel.

If the records don’t match, then each transaction is manually checked using the reference ID present in the system.

This task additionally takes up to a whole day.

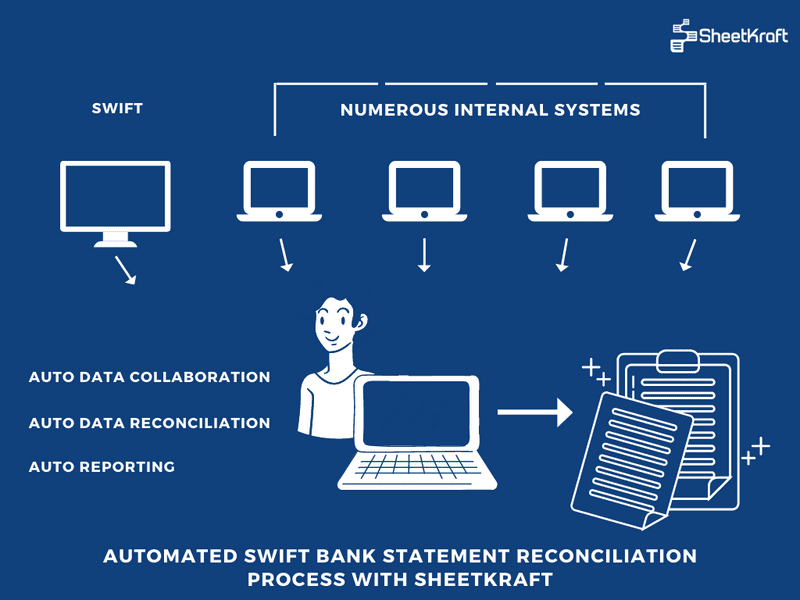

Bank Statement Reconciliation Made Easy Using Automation

A good reconciliation automation system can be a game-changer for this process. Apart from reducing the amount of manual work involved, it would help banks eliminate errors, improve efficiency, and drastically reduce the time taken to complete the task.

For our client, SheetKraft’s reconciliation module helped them automate the process with ease. All the files are directly extracted from the respective system’s database.

This abolished the need for manually downloading & collating the data from dozens of sources.

The activity is now scheduled at a preferred time as is convenient for the Operations team. By default, this value is set to the current business day.

So, without any manual intervention, the bank’s operations team receives the SWIFT Bank Statement Reconciliation summary reports in their mailbox. Additionally, it is also generated at a shared drive path as instructed.

After automating with SheetKraft’s reconciliation module, the SWIFT bank statement reconciliation now takes less than 5 minutes.

SheetKraft's bank statement automation reduced turn around time from 1 man day+ to mere 5 minutes.

TAGGED:Accounts MatchingSWIFTBank Reconciliation

Let's talk

Address

7th floor, Unit No. 715, C Wing,

Kailas Business Park, S. Veer Savarkar Marg,

Park Site, Vikhroli (W), Mumbai-400079.